Erin Hochin's representative with Indiana Ron and Mary Kay Mattingley and Peggy Wire's waiter will help them on how President Donald Trump's “tax -free” policy is. (Credit: White House)

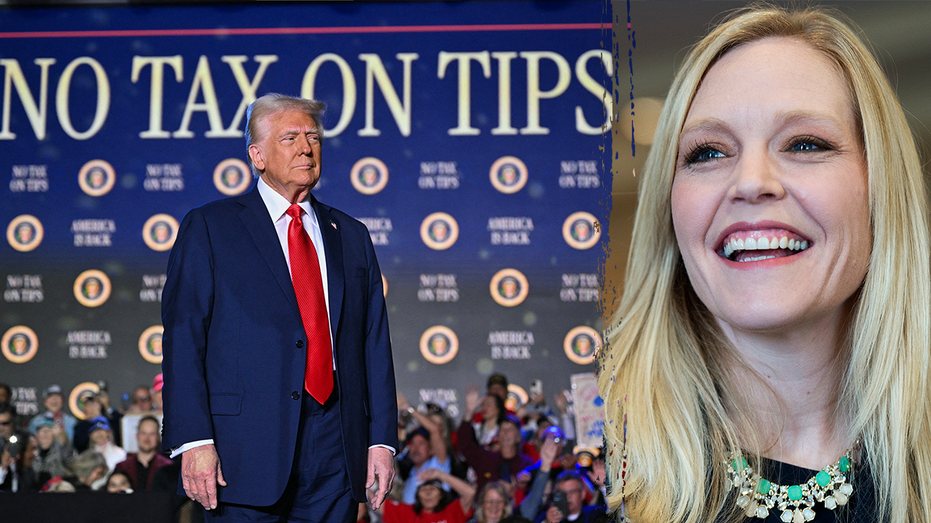

First in the fox: Representative Erin HochinR-Ind. , Highlights how the president Donald TrumpThe “Tax -Tips” policy in a video released by the White House on Wednesday supports working -class Americans.

Hochchin spoke to small business owners, Ron and Mary Kay Mattingley, and Server, Pegie Wire, at Chicken House in Sarajburg, Indiana, about the financial benefits of a great Bill Bill, which includes Trump “Taxless Policy on Tips”Human

“You get more money in our pockets every day when you go home. You get it, you have to keep it. For many of us, we help to pay debt, help save, help it in time.

Hochchin conducted budget talks for Trump's “big and beautiful bill” in three main committees, including parliamentary laws, budgets and energy and trade committees.

Senate unanimously approves $ 25,000 for workers

Representative of Erin Houchin, R-Ind. , Taxless Tips on President Donald Trump in a new White House movie. (Getty Images / Getty Images)

Megabill seeks to provide Trump's second legal legal programs, including tax cuts, immigration, energy and welfare reforms.

GOP is against the claims of “false false” about Medicaid reforms in “Big and Beautiful Bill” Trump

“While I meet the country with small business owners and workers – from Indiana to Mine – what I hear is that job makers need a bad job after four years of failed Biden policies,” said Kelly Lofler, director of small business management.

Last month, the House passed Trump's “Big and Beautiful Bill” with a vote, and the debate is currently being held among the Senate Republicans to impose its version on July 4.

Trump seeks to make his main campaign promises through a great law, which includes tax exemptions on overtime and overtime wages, expanding Trump's tax cuts and jobs in 2017, and reducing social security benefits.

A tip on the counter in a coffee shop. (ISTOCK / ISTOCK)

Lofler told Fox News Digital that from tax cuts to taxes, this law will open a new era of employment, growth and happiness for small business owners.

“I feel that someone is finally listening to us, and what is important to us, and it is doing it,” Wire said to the chicken house.

Wire said he could be discouraged when he does not go home every day.

“She is fighting for men and women, and that's why she went to his position,” Wire said.

While the policy of “taxlessness on the tips” Trump in a great Bill's great law is the Senate Independently approved a bill Last month to create a new tax deduction of up to $ 25,000 for guidance.

The former president of Donald Trump left after speaking at a campaign at the Golf Durrea Trump National Club on July 9, 2024 in Durra, Florida. (Joe Raedle / Getty Images / Getty Images)

However, there are disputes between the Senate's independent bill and the Megabil version of the Majlis. That is, a great Bill's great law does not include a tax deduction hat.

The Senate Bill “expands the business tax credit for part of the payroll tax that an employer paying for some points to include the payroll taxes paid on some of the cosmetic services.”

The new tax deduction, in the Senate bill, is limited to the cash points received and reported for payroll taxes.

Also, “business tax credit for part of the payroll tax that an employer pays for some points, including payroll taxes paid on hairdressers and hair care, nail care, aesthetics and body and spa treatments.”

In the Majlis bill, tax deduction is available from 2025 to 2028 and excludes high income and specialists.

Click to get the Fox News application

With regard to RoadblockThe bill also expands tax credit for federal insurance assistance to cosmetic services such as halls and spa, allowing employers to claim their credit on social security taxes paid for.

“I think President Trump has a real feeling for the middle class, and I think he feels that he is helping,” he said.