US President Donald Trump says he will announce tariffs for all of the US steel and aluminum imports as it reshapes America's trade relations with the world.

This move can have a particular impact on neighboring Canada, which is the largest aluminum supplier to the United States. Trump also threatened to introduce tariffs on a later date of other Canada products as well as in Mexico.

He has already introduced a 10% tax for all products entering China – which responded with his own measures.

The US President says these import taxes are needed to help the US economy and “protect” the country from illegal immigration and a flow of drugs. Economists say they could raise prices for Americans.

What are the tariffs and how do they work?

Tariffs are taxes charged on goods imported from other countries.

Companies that import goods from abroad pay the US government rates.

Trump introduced a 10% tariff for all goods from China. So, a $ 10 product will have an extra charge of $ 1 to it.

Initially, the president said he would impose a 25% tariff on Canada and Mexico goods, but later agreed to pause after both sides agreed to strengthen border security.

Charging a percentage of the value of the product is the most common type of tariff. Another type requires a fixed import figure, regardless of their value.

Why does Trump use tariffs?

Trump is making the promise of a campaign to introduce import duties against some of the closest trading partners in America.

He claims that tariffs will strengthen US production and job protection – for example, in the steel industry in the United States – as well as increasing tax revenue and increasing the economy.

He also tried to justify the metal tariffs – which he also introduced during his first term – as a matter of national security.

Trump also says he uses tariffs to “fight fentanyl scourge,” a powerful medicine that causes tens of thousands of deaths from overdose in the United States every year.

The administration tells him that the chemicals used to attract the medicine come from China, while Mexican gangs supply it illegally and have fentanyl laboratories in Canada.

Canadian Prime Minister Justin Trudeau has said that less than 1% of fentanyl entering the United States comes from his country.

What happens to China, Canada and Mexico?

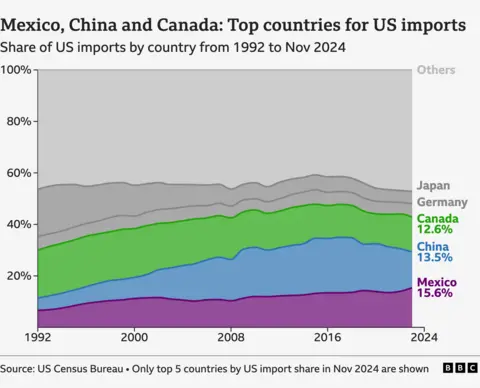

Together China, Mexico and Canada represent more than 40% of the US imports last year, making them some of Trump's most valuable trading partners.

China

A 10% fee for all goods imported from China to the United States came into force on February 4.

Beijing avenges with their own tariffs, which came into force on February 10th. These include 15% tariff for US coal and liquefied natural gas products and 10% raw oil tariff, agricultural machinery and large motor vehicles.

China has repeatedly expressed its opposition to a new trade war of the species that developed between the two countries during the first Presidency of Trump.

Canada

Trump paused for 30 days offered a 25% tariff for all goods entering Canada – which also had to start on February 4.

Canada also stopped its own repayment tariff of 25% over $ 155 billion in worth ($ 107 billion; 86 billion British pounds) from US imports.

In exchange for Trump's pause, Canadian Prime Minister Justin Trudeau said Canada is applying a “$ 1.3 billion border plan” to add “New Chopper, Technology and Border Staff”, as well as “increased resources to stop the flow of flow Fentanyl. “

Much of the Border Security Plan has already been announced in December.

Trump said the delay would allow the US to see “whether a final economic deal can be achieved with Canada.”

Mexico

The proposed 25% tariffs against Mexico are also delayed for a month, as well as Mexico's measures against US goods.

Mexico President Claudia Shainbaum agreed to send 10,000 National Guard members to the US-Mexico border to “prevent drug trafficking, in particular fentanyl.”

President Shainbaum said the US, in turn, agreed to increase measures to prevent traffic to high -power US weapons in Mexico.

Which products will be affected?

During the previous time of Trump, he applied less restrictive tariffs for China. This time it seems that tariffs are applied to all goods from China.

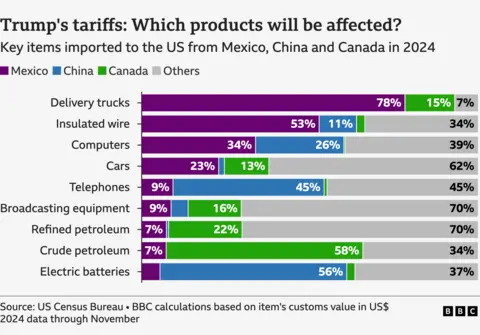

If the measures against goods from Mexico and Canada eventually move forward, a number of items are expected to become more expensive.

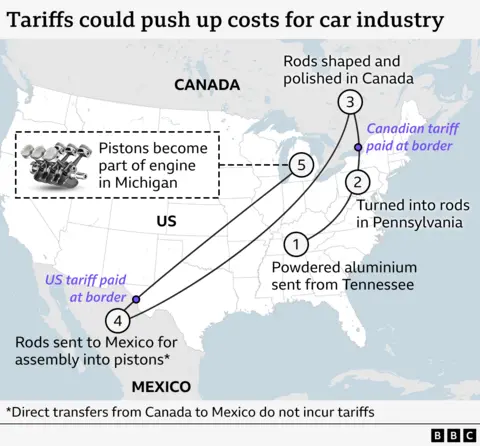

Car production can bear the weight of the effects of the rates.

Parts of vehicles cross the United States, Mexican and Canadian borders many times before the vehicle is fully assembled.

The average price of cars in the US can increase by $ 3,000 due to import taxes, TD Economics financial analyst suggested.

Other Mexico goods that can be affected include fruits, vegetables, spirits and beer.

Canadian goods such as steel, timber, cereals and potatoes could also get more expensive for US consumers.

Canadian energy will be targeted at 10%instead of 25%.

Will the UK and Europe have to pay tariffs?

Trump told the BBC that the United Kingdom was acting “outside the line” without giving further details, but suggested it could be “made”.

The United Kingdom Business Secretary Jonathan Reynolds said the United Kingdom should be excluded from tariffs as the United States exports more products to the UK than imports.

The United Kingdom exports pharmaceuticals, cars and scientific instruments to the United States.

Trump also said he could impose EU tariffs “quite soon” because “they take almost nothing (from the US) and we accept everything from them.”

Last year, the United States had a trade deficit of $ 213 billion with the EU – which Trump described as “atrocity”.

The EU said it would “respond firmly” to any tariffs. US companies Harley Davidson, which produces motorcycles, and whiskey distilleries like Jack Daniel have previously encountered EU tariffs.

Do tariffs cause inflation?

Economists have warned that tariffs are likely to raise prices for US consumers.

For example, sellers can raise the price of the goods they import if they are forced to pay higher duties.

From 2018 to 2023, imported washing machines noted that the price of washing equipment increased by 34%, according to official statistics, before falling after the rates expired.

Some experts suggest that these new tariffs can cause a broader trade war and exacerbate inflation.

Capitol Economics said the annual inflation rate could be increased from 2.9% to 4% for 4% due to the newly announced tariffs.