Charles Schwab and senior investment strategist Liz Anne Sanders analyzes the January CPI report on “monetization”.

An inflation report hotter than expected of January and uncertainty about the influence of the president Donald Trump Expert economists said tariff programs on consumer price could be in the decision to reduce the Federal Reserve.

The Ministry of Labor on Wednesday released the Consumer Price Index (CPI) for January, indicating that inflation was 3 % annually, from 2.9 % in the previous month, after a monthly increase greater than 0.5 %.

In In inflation After the Federal Reserve decided against the fourth consecutive interest rate last month. The uncertainty about Trump's plans for tariffs, which is tax on imported products, and their implementation timetable can lead to a longer expectation to reduce the rate of higher than what is anticipated.

“Today's data re -confirms Powell's decision to reduce the rate on the back torch for a long time,” said Charlie Ripley, a senior investment strategist for Allianz. “In general, inflation data today should force market participants to think about this year's Federal Reserve's ability, especially given the rise in prices, probably not related to any White House tariff activity.”

Inflation rises 3 % in January, hotter than expected

Bill Adams, a senior economist with Comerica Bank, said hot inflation pressure acts as “confirmation that price pressures are still below the level of bubble economics” and “Federal Reserve willingness to minimize speed and possibly even lower rates in 2025 Reinforced.

“Federal Reserve is also watching impact Higher tariffs“These policies can add to inflation because their effects are through the economy and cause the Federal Reserve to increase interest rates above what has been under the status quo,” Adams added. “

Federal Reserve President Jerome Powell said the Federal Reserve is waiting to see how pre -accounting tariff policies are implemented for any inflationary impact. (AFP through Getty Images / GetMages)

Sima Shah, the world's main strategist for managing the main asset, said inflation report “Given the price growth, it creates a very disturbing reading for the Federal Reserve and noted that” the government policy agenda threatens to increase inflation expectations ” – The dynamics that can lead to the risk of inflation “overweight to allow the Federal Reserve to reduce this year's rate.”

Gregory Daco, a senior economist EY, said his company's view is that the Federal Reserve “will maintain an expectation and vision in the coming months” and now he will see only two federal rates in June and December. Daco explained: “If you mix the government's policy, it will reduce inflation and inflation expectations.

Trump explosions are due to lack of feed rates

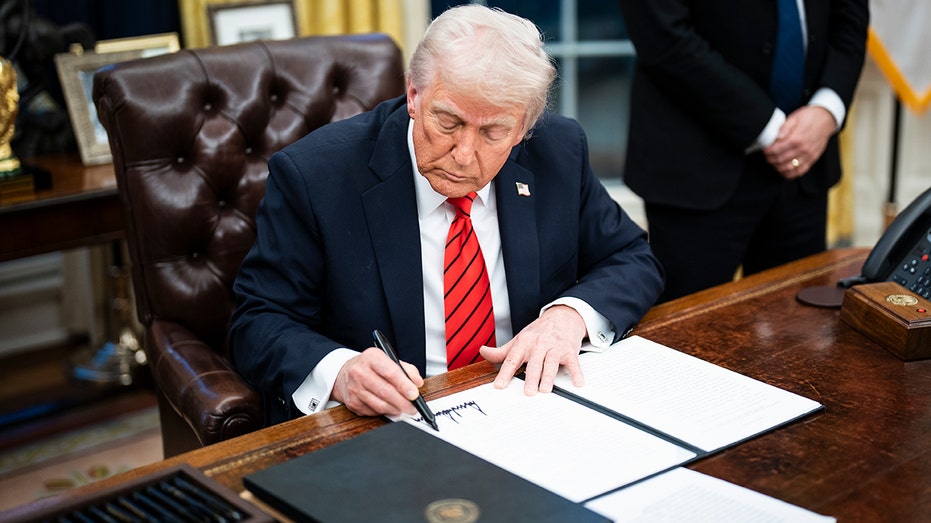

President Donald Trump has imposed new tariffs on China and has threatened Canadian and Mexican tariffs as well as mutual tariffs for other business partners. (Jabin Botsford / The Washington Post through Getty Images / Getty Images)

Ryan Shirin, a senior US economist in Oxford's economy, noted that additional items Tariff in China And other threatened tariffs “have not yet turned their way into inflation data.”

“The Federal Reserve's response to tariffs is not easy, but we believe that tighter monetary policy is likely to make the economy grow from tariffs,” Shirin said. “Federal Reserve requires time to measure how tariffs affect both parties and keep it paralyzed until December, when we think its attention will be changed from inflation to full employment work and Lead to an aggressive reduction in 2026. ”

“The consequences of monetary policy are clear, but it is unclear whether the CPI offers some Trump administration centers on quick movement with some proposed tariffs. He explained: But political optics even low pressure on consumer price Through the tariffs will not be great for the Trump administration.

Get Fox Business on a move by clicking here

Federal reserve seat Jerome Powell On Wednesday, before the Majlis Financial Services Committee, he was asked about the impact of tariffs on the cost of living and the central bank's efforts to insult inflation, and the chief noted that the Federal Reserve did not comment on political decisions.

“Federation “You know, we do not comment on the decisions they have by those who have this position,” Powell said. We try to join our knitting. In this particular case, it is possible that the economy will evolve in ways that we have to do with our policy rates due to tariffs or to some extent due to tariffs. But we cannot know what policies are approved as long as we really know. “