Senator Kevin Cramer, RN.D. To discuss the “refreshing” approach of the Trump administration, it comes to foreign policies and ignores the “lower line”.

Managing Director of several largest US agents are due to meet with a group of senators at a roundtable on Thursday at Capitol Hill Disposal matters Following the proceedings last week on this issue.

CEO JPMORGAN ChaSE Jimmy DamonCEO of the Central Bank of America Brian Munihan, CEO of Richard Firbank, Wells Fargo CEO, Charles Sharif, CEO of the United States Bank Andrew Demchak, PNC CEO and Bill Rogers, TRUIST CEO. To participate.

The meeting follows a pair of congressional proceedings on last week's disagreement, which, in the process by which banks close customer accounts, are often in response to concerns about regulatory adaptation.

Jobs and individuals involved in the cryptocurrency and digital assets industry, as cannabis businesses in countries where marijuana is legal. Supervisory guidelines on the risks of reputation have also led to the elimination of accidents related to the firearms industry and other conservative institutions.

Senate's banking panel hears of the remarkable testimony: “Very disruptive”

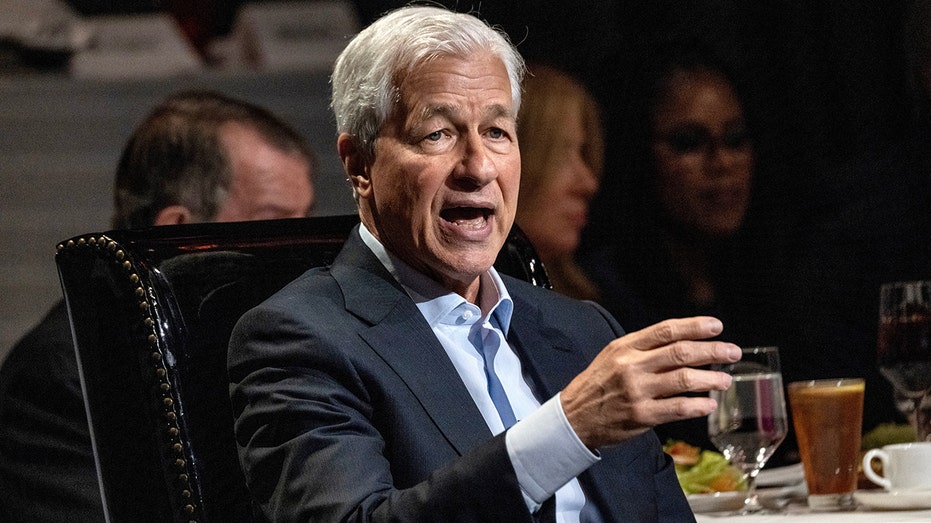

Senators are set to meet with leading banking CEOs to talk about solutions to discussions. (Joe Raedle / Getty Images / Getty Images)

President Donald Trump Last month, he highlighted the issue of political humiliation in statements to the World Economic Forum, where he accused the US Bank of destroying the conservatives, while Minyan to adjust a question and answer session with the President. Helped.

Minian spoke with Fox Trade at Thursday and was asked about Trump's claims. He replied, “We're all banking, thank you.”

Bank of AmericaJPMorgan Chase and other banks have rejected a decline in banking access to customers over political concerns.

Trump confronts the US Central Bank CEO for failing to use “conservative trade”

Brian Minian, CEO of the US Central Bank, rejected the claims that the bank discriminates on political views. (Cyril Marcelisi / Bloomberg via Giti Pictures / Getty Pictures)

Damon called for greater transparency about the appearance of last month in the podcast “Unsshakeables”.

“I think we should let you tell you. … When we report things, the federal government probably should be aware of it, and we have to do much cleaner lines about what we should do and what There is no need to do. ” Damon said. “We have been complaining about this for years. We have to fix it.”

Bank's chief executive says Trump's financial policies are re -“location number 1 for investment”

Jimmy Damon, CEO of JPMorgan Chase, calls for reforms to banking laws to make more transparency in decision -making. (Photographer: Victor J. Blue / Bloomberg through Getty Images / Getty Images)

The senators of both sides of the corridor confirmed the need to fix the problems at the Senate Banking Committee meeting last week, with the head of the Scott team, Rs.C and a member of the ranking. Elizabeth WarrenD-Mass. , They said they want to work on a two -party fix.

Deir Kevin KramerRN.D. , Today's meeting previewed Fox Business Network Network Preview on Wednesday and said, “He is anxious to hear all of them.” Kramer noted: He introduced laws in the name of fair access to the banking law seeking to address issues related to the disposal and 41 people in the Senate.

“I don't want to do something special, but I want them to discriminate over the whole industry, whether it is oil and gas or the private, ammunition and industry, or industry, or industry. Crazing is forbidden.

Get Fox Business on a move by clicking here

The Bank's Big Roundtable was first reported by Politico and approved by Fox Business.

Fox Business' Chase Williams has been involved in this report