Ghetto images

Ghetto imagesDuring his election campaign, Donald Trump promised the Americans that he would introduce a new era of prosperity.

Now, two months after his Presidency, he paints a slightly different picture.

He warned that it would be difficult to reduce prices and the public must be prepared for a “little disturbance” before it can return the wealth in the United States.

In the meantime, analysts say the chances of decline are increasing, pointing to his policies.

So, Trump is about to cause a recession in the world's biggest economy?

Markets fall and the risks of recession are increasing

In the US, the recession is defined as a prolonged and broad decrease in economic activity, usually characterized by a jump in unemployment and decline in income.

A chorus of economic analysts has warned in recent days that the risks of such a scenario have been increasing.

The JP Morgan report put the chance of a recession of 40%, compared to 30% at the beginning of the year, warning that US policy is “inclined to grow” while Mark Zandy, a chief economist at Moody's Analytics, raised the odds of 15% to 35%, citing tariffs.

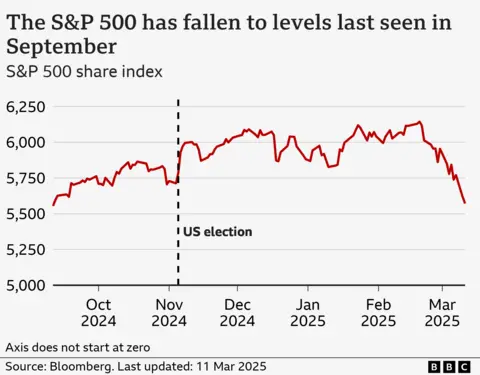

The forecasts came like the S&P 500, which tracks 500 of the largest companies in the United States sharply sank. Now she has fallen to her largest level since September in fears for the future.

Market shocks are partly guided by fears about new import taxes called Tariffs, which Trump has introduced since he took office.

He has hit products from the three largest trading partners in America with new duties and threatens them more widespread in moves, which analysts think will increase prices and limit growth.

Trump and his economic advisers warn the public to be prepared for some economic pain while seeking to reject The market refers to a significant change from its first term when it often cite the stock market as a measure of its own success.

“There will always be changes and adjustments,” he said last week in response to business requests for more security.

The posture increased investors' concerns about his plans.

Last week, Goldman Sachs raised its recession bets from 15% to 20%, saying it was changing policy as a “key risk” for the economy. But he noted that the White House still has “the opportunity to pull away if the risks of a decrease begin to look more serious.”

“If the White House remains engaged in its policies even in the face of much higher data, the risk of recession will increase more,” the company analysts warned.

Tariffs, uncertainty and growth delay

For many companies, the biggest question is the tariffs that increase the cost of American business by putting taxes on imports. As Trump reveals tariff plans, many companies are already facing more margins, while being retained by investment and hiring while trying to understand what the future will look like.

Investors are also worried about major redundancies in government labor and government spending.

Brian Gardner, Chief of Washington's Political Strategy at the Investment Bank, said that business and investors believe Trump had intended tariffs as a negotiation tool.

“But what the president and his cabinet signal is actually a bigger deal. It's a restructuring of the US economy,” he said. “And that's what the markets have been moving in the last few weeks.”

The US economy has already been delayed, designed in part by the Central Bank, which maintained interest rates higher to try to cool the activity and stabilize prices.

In recent weeks, some data have suggested a faster weight loss.

Retail sales fell in February, trust – which appeared after Trump's election in several consumer and companies studies – and companies, including large airlines, retailers such as Walmart and TARGET, and manufacturers warn of withdrawal.

Some analysts are worried that the fall in the stock exchange can cause more and more increasing costs, especially among higher -income households.

This could lead to a big hit of the US economy, which is guided by consumer expenses and becoming more and more dependent on these more rich households, as families with a lower income are facing inflation.

The head of the US Central Bank Jerome Powell offered assurances in a speech last week, noting that the moods have not been a good indicator of behavior in recent years.

“Despite increased levels of insecurity, the US economy is still in a good place,” he said.

But at the moment, the US economy is deeply linked to the rest of the world, warned Kathleen Brooks, a research director at XTB.

“The fact that tariffs can break this at the same time, that there are signs that the American economy is weakening anyway .. it really nourishes the fears of recession,” she says.

Stock Exchange in Technology ripened for correction

The inconvenience of the stock exchange is not related to Trump.

Investors were already trembling about the possibility of correction, after major profits in the last two years, led by the sharp leakage of technological shares, fueled by investor optimism about artificial intelligence (AI),

Chipmaker Nvidia, for example, saw the price of its shares jumping from less than $ 15 in early 2023 to nearly $ 150 last November.

This type of rise has caused a debate on AI balloon – with investors with a high signal for signs of it, which would have a great influence on the stock market, regardless of the dynamics in the wider economy.

Now, with the views of the darkening of the US economy, AI optimism is becoming even more difficult to maintain.

Technical analyst Jean Munster of Deepwater Asset Management wrote on social media this week that his optimism “took a step back” as the chance of recession has increased “measurable” in the last month.

“The bottom line is that if we get into a recession, it will be extremely difficult for AI to continue,” he said.