Bbc

BbcThe United States has “missed the ball” of the production of chips over the years, allowing China and other Asian hubs to gain forward. So said Gina Raymondo, who at the time was the US Trade Secretary, in an interview with me in 2021.

Four years on, the chips remain a field for battle in the US race for technology, and US President Donald Trump now wants the turbo to charge an extremely complex and delicate production process that has taken other regions to improve.

He says his tariff policy will free up the US economy and bring jobs home, but it is also the case that some of the largest companies have long been struggling with the lack of qualified workers and poor quality of their US factories.

So, what will Trump do differently? And given that Taiwan and other parts of Asia have the secret sauce in creating high -precision chips, is it even possible for the United States to produce them on a scale?

Microchip preparation: The secret sauce

The semiconductors are central to the power supply of everything – from washers to iPhones and military jets to electric vehicles. These tiny silicon waffles, known as chips, have been invented in the United States, but today in Asia, it is the most advanced chips to be produced in a phenomenal scale.

Making them is expensive and technologically complicated. The iPhone, for example, may contain chips that are designed in the United States, made in Taiwan, Japan or South Korea, using raw materials as rare lands that are extracted mainly in China. They can then be sent to Vietnam for packaging, then in China for assembly and testing before being sent to the United States.

Ghetto images

Ghetto imagesIt is a deeply integrated ecosystem that has been developing over the decades.

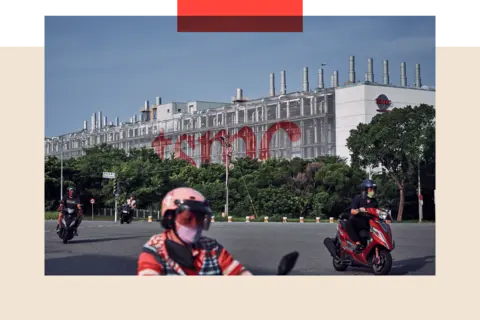

Trump praised the chip industry, but also threatened him with tariffs. He told the industry leader, the Taiwanese semiconductor production company (TSMC) that he would have to pay a 100%tax if he did not build factories in the United States.

With such complex ecosystem and fierce competition, they must be able to plan higher costs and investment conversations in the long run, far beyond the Trump administration. Continuous changes in policies do not help. So far, some are willing to invest in the United States.

The significant subsidies that China, Taiwan, Japan and South Korea have given private chip companies are a big reason for their success.

This was largely the thinking behind the American Chip and Science Law, which became a law in 2022. With President Joe Biden – an effort to redirect chips and diversify supply chains – by allocating grants, tax loans and subsidies to stimulate domestic production.

Ghetto images

Ghetto imagesSome companies such as the world's most large TSMC and the largest smartphone manufacturer in the world Samsung in the world have become the main beneficiaries of the legislation, with TSMC receiving $ 6.6 billion grants and plants in Arizona, and Samsung has received approximately $ 6 billion for the equipment.

TSMC has announced another $ 100 billion investment in the US with Trump, at the top of $ 65 billion promised for three factories. Diversifying chip production also works for TSMC, with China repeatedly threatening to take control of the island.

But both TSMC and Samsung have faced their investments, including increasing costs, difficulties in raising qualified labor, delaying construction and resistance from local unions.

“This is not just a factory where you make boxes,” says Mark Einstein, a Market Intelligence FIRST Director. “The factories that make chips are so high -tech sterile environments, they take years and years to build.”

And despite investment in the US, TSMC said that the greater part of its production would remain in Taiwan, especially its most modern computer chips.

Did China try to steal Taiwan's skill?

Today, TSMC plants in Arizona produce high quality chips. But Chris Miller, author of Chip War: The struggle for the most critical technology in the world, claims that “they are a generation behind the largest part in Taiwan.”

“The question of scale depends on how much investment is being made in the US against Taiwan,” he says. “Today, Taiwan has a much more capacity.”

The reality is that it took decades to be able to build this capacity, and despite the threat of China to spend billions to steal Taiwan's men in the industry, it continues to flourish.

Ghetto images

Ghetto imagesTSMC was the pioneer of the Founding Model, where chip manufacturers took our designs and produced chips for other companies.

Riding a wave of Silicon Valley starters such as Apple, Qualcomm and Intel, TSMC managed to compete with us and Japanese giants with the best engineers, highly qualified labor and knowledge sharing.

“Can the US make chips and create jobs?” He asks G -N Einstein. “Of course, will they reach the chips to a nanometer? Probably not.”

One of the reasons is Trump's immigration policy, which can potentially limit the arrival of qualified talent from China and India.

“Even Elon Musk had a problem with immigration with Tesla engineers,” says Mr Einstein, citing Musk's support for the US visa program of the United States, which carries qualified workers in the US.

“This is a narrow place and there is nothing they can do unless they change their position on immigration entirely. You can't just magical doctoral students from nothing.”

The global knockout effect

However, Trump has doubled from tariffs by ordering an investigation into the national security trade in the semiconductor sector.

“This is a wrench in the machine – a big wrench,” says G -n -Einstein. “Japan, for example, founded its economic revival of semiconductors and tariffs were not in the business plan.”

The longer-term impact on the industry, according to Mr. Miller, is likely to be a new focus on domestic production in many key economies in the world: China, Europe, USA.

Some companies may look for new markets. Chinese technology giant Huawei, for example, has expanded to Europe and emerging markets, including Thailand, UAE, Saudi Arabia, Malaysia and many countries in Africa in the face of export control and tariffs, although margins in developing countries are small.

“China will eventually want to win-it has to innovate and invest in research and development, see what he did with Deepseek,” says Mr Einstein, citing China's AI chatbot.

“If they build better chips, everyone will go to them. The cost efficiency is something they can do now and look forward, it's ultra-technological production.”

Meanwhile, new manufacturing centers may emerge. India has many promises, according to experts who say there is more chance of integrating it into the US chip supply chain – it's geographically closer, labor is cheap and education is good.

India has signaled that it is open to the production of chips, but faces a number of challenges, including the acquisition of land for factories and the production of water – the chip needs the highest quality water and many of it.

Market chips

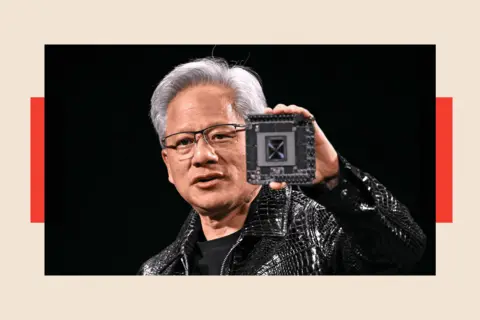

The chip companies are not completely at the mercy of the tariffs. Judicial reading and demand for chips from major US companies such as Microsoft, Apple and Cisco could put pressure on Trump to turn any fees in the chip sector.

Some internal persons believe that the intensive lobbying of Apple CEO Tim Cook has secured release from smartphones, laptop and electronic tariffs, and Trump has canceled a ban on the chips that NVIDIA can sell in China as a result of lobbying.

Asked specifically about Apple's products on Monday in the Oval Cabinet, Trump replied, “I'm a very flexible person,” adding that “maybe things will appear, I'm talking to Tim Cook, I recently helped Tim Cook.”

Ghetto images

Ghetto imagesEinstein believes that everything comes down to Trump ultimately try to make a deal -he and his administration know that they can't just build a bigger building when it comes to chips.

“I think what Trump's administration is trying to do is what he has done with the Tiktok Bytedance owner. He says I won't let you operate in the US more unless you give Oracle or another American company,” says Einstein.

“I think they are trying to accelerate something like this here – TSMC will not go anywhere, let them just force them to make a deal with Intel and take a slice of pie.”

But the plan of the Asian semiconductor ecosystem has a valuable lesson: no country can manage the chip industry on its own and if you want to make advanced semiconductors, effectively and in scale – it will take time.

Trump is trying to create a chip industry through protectionism and isolation when what allowed the chip industry to appear across Asia is the opposite: cooperation in a globalized economy.

BBC Indepth is the new home of the website and the application for the best analysis and experience of our best journalists. Under a distinctive new brand, we will introduce you to new perspectives that challenge the assumptions and the deep reporting of the largest problems to help you make sense of the complex world. And we will show content that provokes the thought of All BBC Sounds and Iplayer. We start small, but thinking big and we want to know what you think – you can send us your feedback by clicking the button on the bottom.