Jim Paulsen, a senior Strategic Strategist for Investment in the Leuthold Group, argues how long it takes to consolidate the stock market after President Donald Trump's tariffs on “revenue generation”.

Investors are riding in a rider and of fun with the US stock market under severe fluctuations among heavy sales as President Trump stands firmly standing and bringing his widespread tariff Strategy against most of our business partners.

The bear markets and the territory of correction

The S&P 500 briefly reached the bear market on Monday, following the Nasdaq Composite, which was located in the bear market or 20 % of its latest full -time peak on Friday, to the bear market. The Dow Jones industrial average is shy on Monday.

This as the CBOE or VIX oscillation index for short, which measures the fluctuations, reaches the highest level in 5 years and is suspended at 46.

Don't be afraid

While many main street investors who are watching their securities, 401 (K) or retirement accounts are not sold, selling to a sales is a big thing for long -term investors.

Said “You never sell with horror, never sell in horror” Ken Fisher, Founder, Fisher Investment In an interview with Warren and the company, $ 295 billion in assets.

Sale of horror will cost you

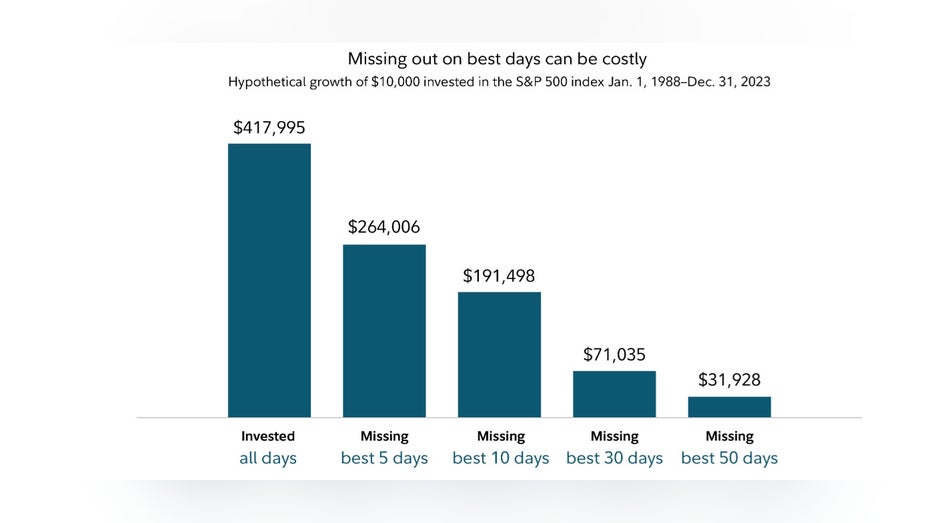

According to an analysis that has been loyal to Fidelity with Fox Business, those who may participate in horror sales lose the market when they return.

For example, $ 10,000 has invested in S&P 500 from January 1, 1988 to December 31, 2023, losing more than $ 264,000 by losing the best five days of investment.

Losing the best days can be expensive (Loyalty Investment)

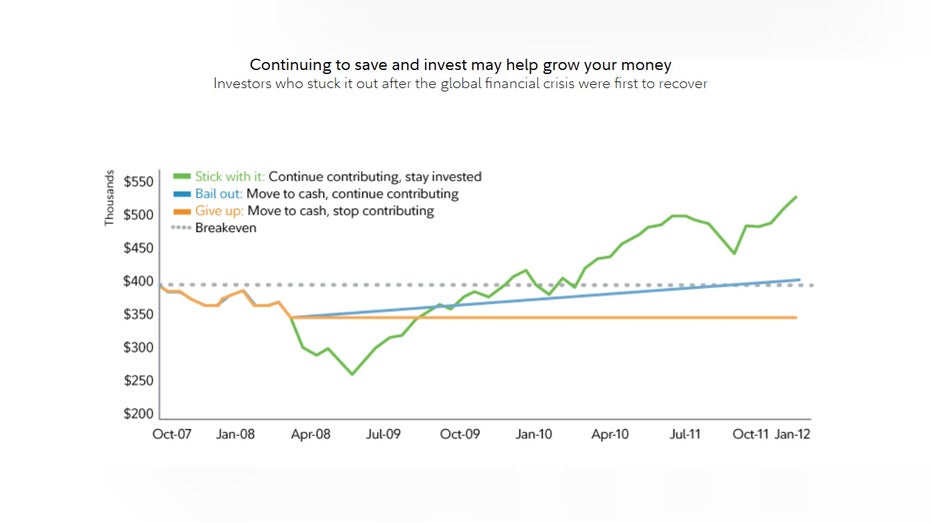

In addition, the firm points out that “historically, every severe recession has finally made its place for greater growth,” with the firm showing hypothetical decisions taken during the global financial crisis from 2007 to 2012, for a portfolio of 70 %/30 % of the securities mix and $ 4,000.

Loyalty wrote: “It took 52 months for the investment to return to the peak before the global financial crisis.” Those who stayed during this period increased about $ 500,000. Those who moved to cash and refused to participate reduced their balance to about $ 350,000.

Investors who destroyed it after the global financial crisis were first recovered (Loyalty)

“You see the target prices decline for the year, the estimation of income is reduced, the whole step,” said Jim Paulsen, a senior investment strategist in Wales Fargo.

Game mode?

The tariff pressure is said to be in its early days and it is unclear when and how the dust will be resolved. Companies such as Goldman Sachs and JPMORGAN have set their chances for US recession by dialing Jimmy Damon, CEO of JPMORGAN Monday

Chari Powell says tariffs that possibly raise inflation can be stable

“In the short -term case, we are likely to see inflationary results, not only about imported goods but also with domestic prices and increased input costs in domestic products. How this is distributed on various products. It depends partly on their replacement and pricing. The tariff menu can reduce the recession in their question, but it can reduce the recession.

Last week, Federal Reserve President Jerome Powell repeated similar emotions.