The CEO and CEO of Blackrok, Larry Fink, conduct tariff talks with China and market fluctuations in the “County Countdown”.

Portfolio 60/40, stocks in bonds, have long been tested and real for those who create their retirement nest eggs with a safety network of diversity. But when, they are changing CEOs, and CEO Blackrock, Larry Fink, is taking advisory.

“The generation of investors have followed this approach and have a combination of the whole market rather than individual securities. Fink wrote in his 2025 letter to investorsHuman

Blackrok Larry Fink's annual letter to investors

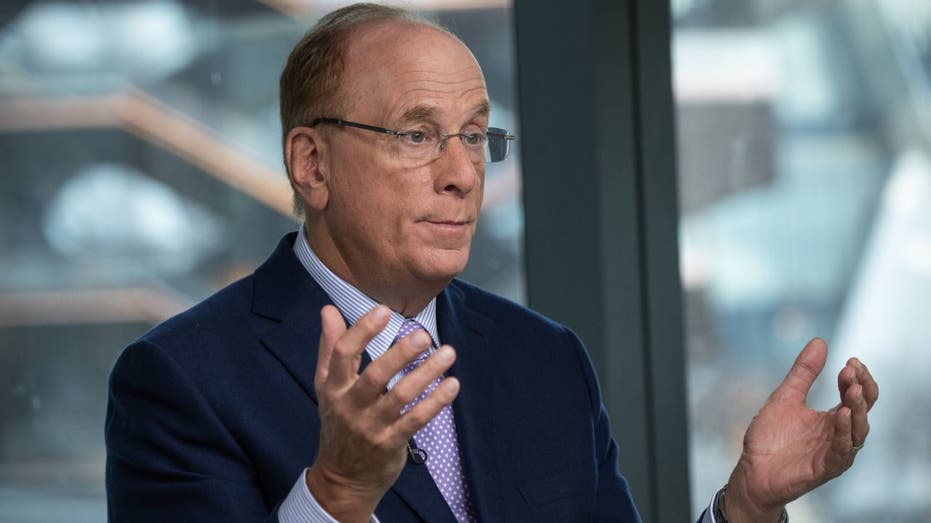

Larry Fink, Chairman and CEO of Blackrock Inc. , Right and Adebayo Ogunlesi, President and Executive Director of World Infrastructure Partners (GIP), during Bloomberg's television interview in New York, the United States, on Friday, January 12 (Photographer: Victor J. Blue / Bloomberg through Getty Images / Getty Images)

In the case of infrastructure, Fink supported its inflation protection features. He noted that producing revenue from payment, stability against unstable public markets and solid returns even with 10 % allocation.

Blackrock has recently paid $ 23 billion for Panama Channel ports. For example, charging the cost of ships can make income through the waterways.

Blackrock pays $ 23 billion for Panama Channel ports

| Tick | Security | The last | Change | Changing % |

|---|---|---|---|---|

| Front | Blackrock Inc. | 875.75 | +9.64 |

+1.11 % |

Even Blackrock, with over $ 11 trillion assets The world's largest asset manager is a composition of 50/30/20 or another division with alternative assets, it can be reasonable for smaller investors and retail retail.

“For someone who has a lot of time and has assets to justify privacy, we think this is a really exciting opportunity because of the diversity in a portfolio.” Kitty KelingnismThe senior strategist of investing in the EDELMAN financial engines told Fox Business.

Mortgage rates among market fluctuations

“From our point of view, when we think about making those really strong securities for our customers, but when we think what we think for most investors who are not necessarily a great net value, private markets have really interesting features, and seeing how they are now in the public market,” he said.

In S&P 500, the broadest US stock market benchmarkLost 10 % this year.

Get Fox Business on a move by clicking here

The US main bond index has increased by about 2 % this year. According to the company, the securities are measuring more than a year at a fixed price with a degree of US capital with more than a year.